Britain Sets Itself On Fire (Again)

It is a truly staggering achievement for any British Chancellor to make a policy announcement so detached from reality that it immediately tanks the British Pound. It is surely an achievement unsurpassed in British political history to do so just days after taking office.

Enter Kwasi Kwarteng, and his unique brand of shameless Reaganism.

You don't need a PhD in Economics to understand that in a country where inequality is spiralling and the cost-of-living is skyrocketing with inflation and rising interest rates, giving the super-rich an enormous tax cut might not be the best idea.

The result of Kwarteng's budget – and it is a budget, it's only not being called a budget to obscure the fact that they would need to publish OBR forecasts if they did call it a budget – is that he has doubled down on this inequality.

Let's look at the headlines from The Resolution Foundation, who helpfully did and published the analysis that the Government declined to:

- Next year [the tax cuts] will see someone earning £200,000 gain £5,220 a year, rising to £55,220 for a £1 million earner. Those on £20,000 will gain just £157.

- Those living in the South East or London will see over three-times (on average, £1,600) the gains of those in the North East, Wales or and Yorkshire (an average of £500)

- The South is also where the main impact of a welcome cut to stamp duty will be felt: the tax bill on the sale of the average first-time buyer home in London will fall by £6,300, compared to no gain for the average first-time buyer in the North East.

If you factor in the increase in bills, mortgages and food coming down the road in the next year, poorer families have been given a real-terms pay cut; the mega-rich have been given a huge pay rise.

Even the Tories go-to vote winner, cutting stamp duty, fails to address the fundamental problem with their economic medicine. House prices in the UK are high because demand outstrips supply. We have not built enough houses for years. Cutting stamp duty increases demand, but does nothing for supply. That simply allows house builders to charge more for their new builds, and sellers to pocket the difference when it comes to their sale. This drives up house prices further in the long term, and decreases revenue to the treasury.

Again, property owners tend to represent the more affluent in society. Stamp duty cuts do nothing for renters, whose rent will undoubtedly soar as landlords come to remortgage their properties in a climate of higher interest rates. In short, it further squeezes the poor and leaves the Government out of pocket.

The truth is that this goes far beyond an idealogical disagreement. This isn't just a "protect the rich" budget – although it clearly is that too – it is a budget that has caused utter panic in the markets.

The markets know that this budget is not fiscally sustainable. They know that it has to be funded by enormous increases in borrowing, and given that this type of neoliberal economic thinking has demonstrably and repeatedly failed in the past, the portents aren't good.

So much so that the Bank of England, who raised interest rates only a week ago, are rumoured to be convening an emergency meeting to raise them again in response to Kwarteng's hand grenade. While rates were forecast to peak at around 4% last week, new suggestions echo around the corridors of power that 6% is feasible – all as a result of Kwarteng's incompetence.

Alongside the borrowing, the Chancellor has confirmed that huge spending cuts of £36 billion also have to be enacted. After a decade of austerity trimming essential services back to the barebones, there is nothing left to cut without causing serious damage to prosperity, regardless of where the cuts occur.

And that is why the forecast is so bleak. There are few assets left to sell. There are few places left to cut. This type of flagrant spending, primarily to fuel enrichment for the already wealthy beggars belief. One school of thought is that this is a "Scorched Earth" approach: that the Tories know they are done for at the next general election, and they plan to enrich themselves, their donors and their families as much as possible in the mean time.

Perhaps an even more terrifying school of thought would be that these people genuinely believe in what they're doing. Perhaps they are so detached from reality that they believe in trickle-down economics; they believe in Reaganism; and they believe the utter bilge spewed in their Britannia Unchained writings.

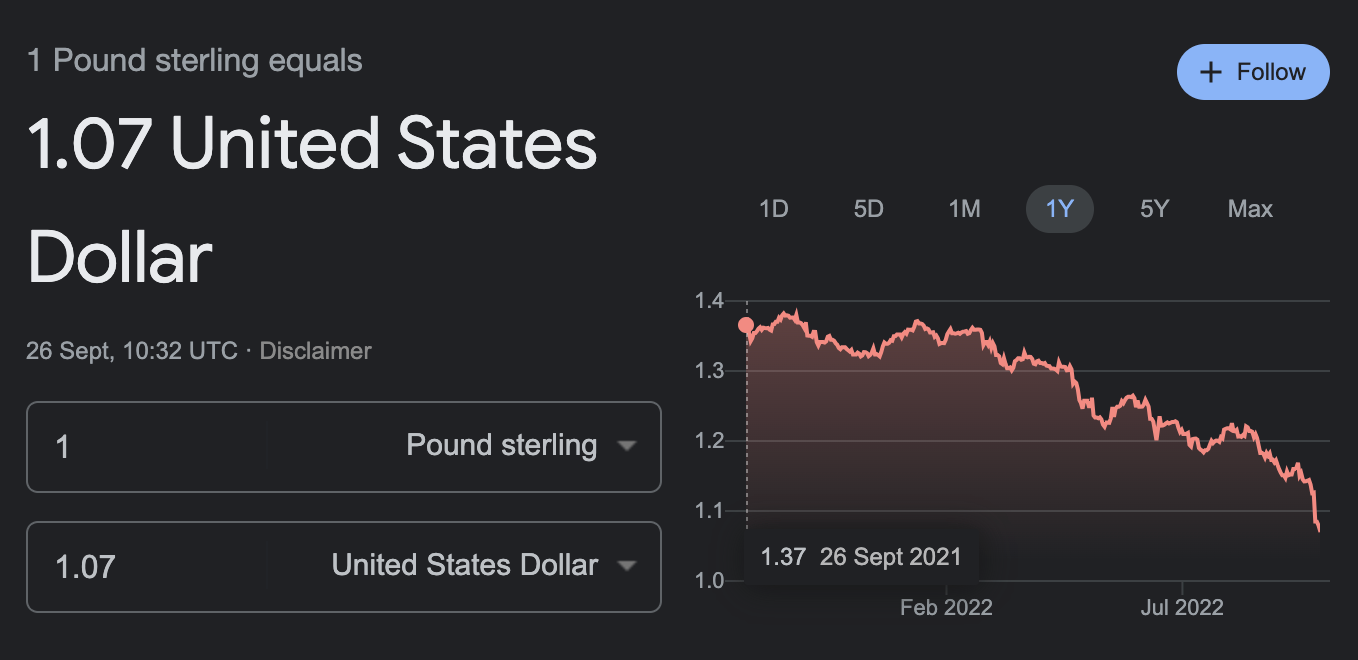

This morning, the pound fell to its lowest level against the US Dollar in history. Ten year gilt yields reached their highest cost since 2008. In basic terms, the economy has taken a major hit in just a few days. A hit it did not need after Covid and Brexit. And like Brexit, it was a political choice.

After falling as low as $1.03 this morning, the pound has recovered slightly to $1.07. This time last year, it sat at $1.37. Before Brexit, it sat at around $1.60, and before the 2008 Financial Crash it sat at over $2.00.

These are enormous changes, the importance of which cannot be overstated in an international marketplace dominated by the US Dollar. Everything imported becomes more expensive. Wages continue to broadly stagnate in this country as costs of living go through the roof.

Britain now runs a real risk of moving from a stagnant, underperforming economy to an economy in real risk of economic collapse. Before the end of the Tory leadership race, speaking to The Spectator, Rishi Sunak predicted what would happen if Truss and Kwarteng carried out their spending cuts as advertised.

He wrote, "There will be a run on sterling. The gilts market will be in freefall. And the FTSE will tumble as global investors take fright and sell off every form of British asset. It might only take a few days, or the government might stagger through until the end of September, but before long Liz Truss and her new Chancellor Kwasi Kwarteng will have been forced to call in the IMF to stablise a collapsing economy."

He was criticised or ignored at the time, with his warnings cast off as the desperate death throes of a dying leadership campaign. As it turns out, he has so far been bang on the money.

Former US Treasury secretary Larry Summers stated that the "UK is behaving a bit like an emerging market turning itself into a submerging market." He added, "Between Brexit, how far the Bank of England got behind the curve and now these fiscal policies, I think Britain will be remembered for having pursued the worst macroeconomic policies of any major country in a long time."

These are damning verdicts, but it is the reality in which we find ourselves. We are governed by a group of people so unfit to run the country that they risk collapsing it. They are a group of populist zealots willing to pour petrol on the flames of the very culture war they created in order to distract from their corruption.

The warning signs were there during the Brexit campaign. We were told that the real motivation behind leaving the European Union was a bonfire of regulation that is now beginning. We were told it was to avoid scrutiny from anti-tax avoidance legislation in Brussels. We were told it was to enable the Tories to rollback on fundamental protections to workers, from maternity pay, working time directives and food standards – all things that squeeze the profitability of companies by insisting we are protected with standards. Now, lo and behold, Jacob Rees-Mogg posits the question of whether we ought to rethink the entire British state, and whether it should continue to provide "certain functions" at all.

Of course, the public would never vote for such things – at least not in 2016, prior to everyone being stoked up and factionalised by culture wars and misinformation. So the only way to do so was to run the Leave Campaign as they did: packed full of lies. They said the NHS would be better funded by virtue of the Brexit dividend; they said immigration was bad, and we should send foreigners back to distant lands; they said prices would fall as part of the fairy-tale sunlit uplands of Brexit. All were lies. All have been proven to be lies.

It's been six years since Britain voted to leave the European Union, putting its trust in the hands of the Conservative Party. Project Fear has become Project Reality. The warnings have become realised prophecies. The ageing foundations of the British state have moved from being a little dusty and outdated to visibly creaking and cracking under the strain of delusional, fantasist policies. The economic strength of the United Kingdom has moved from stagnation to the brink of collapse in just a few short years.

The Tories must be removed from office as soon as possible.