Truss' Energy Cap Is Economically Illiterate

In events that would have seemed beyond impossible in 2015, Liz Truss became Prime Minister of Great Britain and Northern Ireland yesterday. Buoyed by some genuinely incredible front pages (see below), the "dregs of the Conservative Party" had completed their inexorable, desperate rise to the top.

For those of you unfortunate enough to read the Daily Mail, either for work or pleasure, you would be forgiven for thinking that Jesus himself had entered Number 10. They have form, of course, for histrionic expressions of adoration upon the election of a new Conservative PM.

Tuesday's Daily Mail:

— BBC News (UK) (@BBCNews) July 11, 2016

Coronation of Theresa#tomorrowspaperstoday #bbcpapers pic.twitter.com/aWSrOdMjix (via @suttonnick)

This was rather tame, when compared to the ramping up of Pro-Brexit, Anti-Truth rhetoric that would follow. By the following year...

DAILY MAIL: Steel of the new Iron Lady #tomorrowspaperstoday pic.twitter.com/wlD6oFT1FJ

— Neil Henderson (@hendopolis) January 17, 2017

And finally when Boris Johnson rose to power.

Thursday’s Daily Mail: “All guns blazing” #BBCPapers #tomorrowspaperstoday (Via @AllieHBNews) pic.twitter.com/cJZ8SE59Jd

— BBC News (UK) (@BBCNews) July 24, 2019

Nonetheless, this morning's front page almost certainly takes the biscuit.

Wednesday’s Mail: “Together we can ride out the storm” #BBCPapers #TomorrowsPapersToday https://t.co/7FuHsAa3Vz pic.twitter.com/hXZ615F0JG

— BBC News (UK) (@BBCNews) September 6, 2022

Leaving aside the obvious question marks about how the Mail can advertise the now biannual Conservative Leadership victor's election as an "historic special edition", and also leaving aside the demented ramblings about "left-wing Twitterati", it appears they've now decided that the fact that September rain shower came to an end was a sign of divine ordination from God himself. As a point of interest, belief in the "Divine Right of Kings" widely came to an end in the sixteenth century, yet appears to be alive and well at Daily Mail HQ in Kensington.

Yet respite from the elements will be shortlived for Tuss, and indeed for all of us, under her proposed energy cap plans to be announced tomorrow.

Barring a sudden change in the policy, it appears that the Government will subsidise bills to ensure the price cap does not rise above £2,500.

Here's the fundamental problem with that: you're still going to pay for it. Truss at PMQs today ruled out a windfall tax on oil and gas companies forecast to rake in £170 BILLION in excess profits. To impose such a tax would "deter investment in the UK", Truss claimed, using France as evidence of what can happen when a government imposes such taxes. For the record, France is the leading destination for foreign investments in Europe, and has been for the last three years in a row.

With the absence of a windfall tax, the Government is giving energy companies a free pass to make these enormous profits - and it's even going to provide the money for them to do so. The BBC proudly declared in their article "Liz Truss set to cut energy bills for millions" that "customers will not be expected to repay the support". This would suggest that the the government intend to pay the energy companies directly, so customer's don't see the rise on their bill. It would also suggest that there won't be any direct reclamation of that money.

However, this is an enormous amount of money for a taxpayer bailout to the energy issue - approximately £100bn - three times the cost of the Covid Track & Trace debacle, and a fifth of the money spent to bail out the UK banking industry in 2008.

Liz Truss has also proudly declared her ambition to "rule as a Conservative" and lower taxes.

Put simply: borrowing £100bn to make sure the energy companies make great wads of cash is not going to be free. The idea that the taxpayer won't be asked to pay this back is frankly absurd. It may not be called an energy tax on working people, it may be hidden in a National Insurance increase, or VAT increase, or some other kind of stealth tax, but you can rest assured that it will happen. Sir Keir Starmer said as much at PMQs today.

Don't get me wrong: the government has to intervene, and taking this action is better than doing nothing in the short term. But this type of bailout, without a mechanism for responsibly leveraging the money back again, cannot happen without raising taxes further down the line – most likely on working people, again.

In effect, this kicks the can down the road – often the preferred course action of the irresponsible, or those who fail to grasp the importance of a situation.

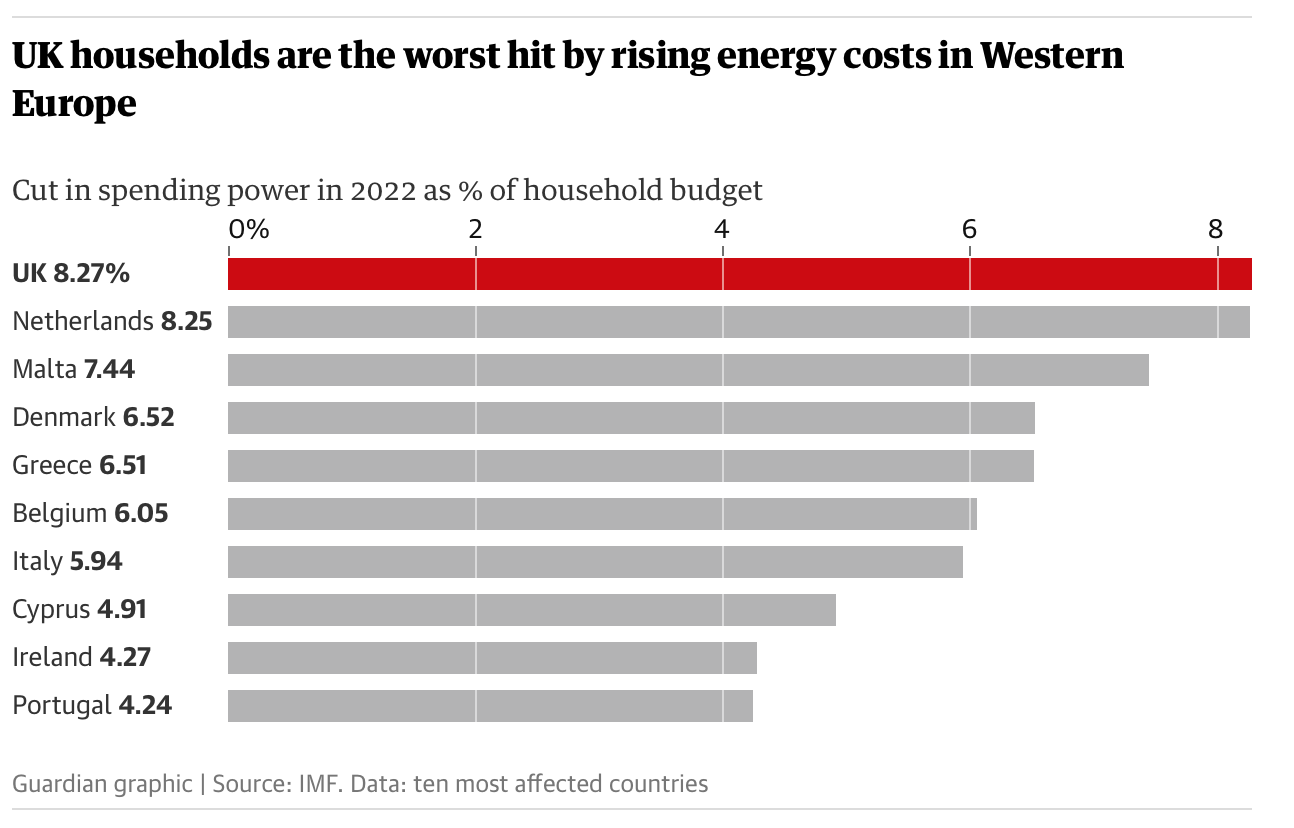

Let's not forget either that freezing the price cap at £2,500 would still represent an enormous increase. Less than a year ago, the price cap was £1,277. The United Kingdom is already the worst hit country in Western Europe, in terms of cut in spending power as a % of household budget.

Truss' price freeze will still see the price cap go up by an additional 25%, adding more misery to already squeezed incomes in a cost-of-living crisis.

In some ways, the plan is the zenith of Conservative ideological thinking: using public funding to guarantee the colossal excess profitability of private enterprise. In the real world, it's folly: another expensive burden on the public purse after the damage of Covid, the ongoing damage of Brexit, and will – one way or another – have to be repaid by you and me.

This, added to the fact that the proposal would not halt energy price increases and instead only blunt them, it seems odd yet grimly predictable for it to be heralded as such as success in the press.

If you want to see a proper, balanced and sensible plan to tackle the energy crisis, you can read one here.